will capital gains tax rate change in 2021

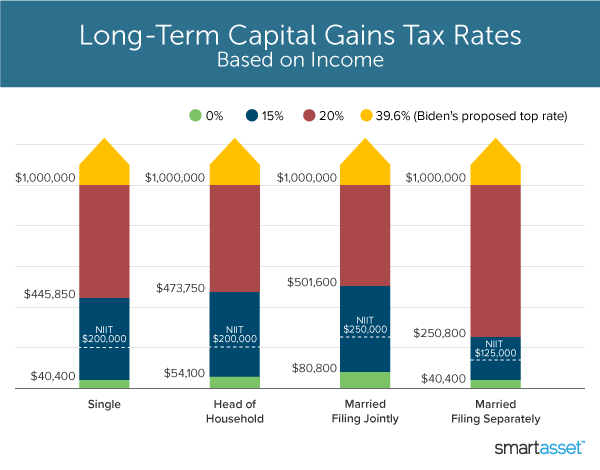

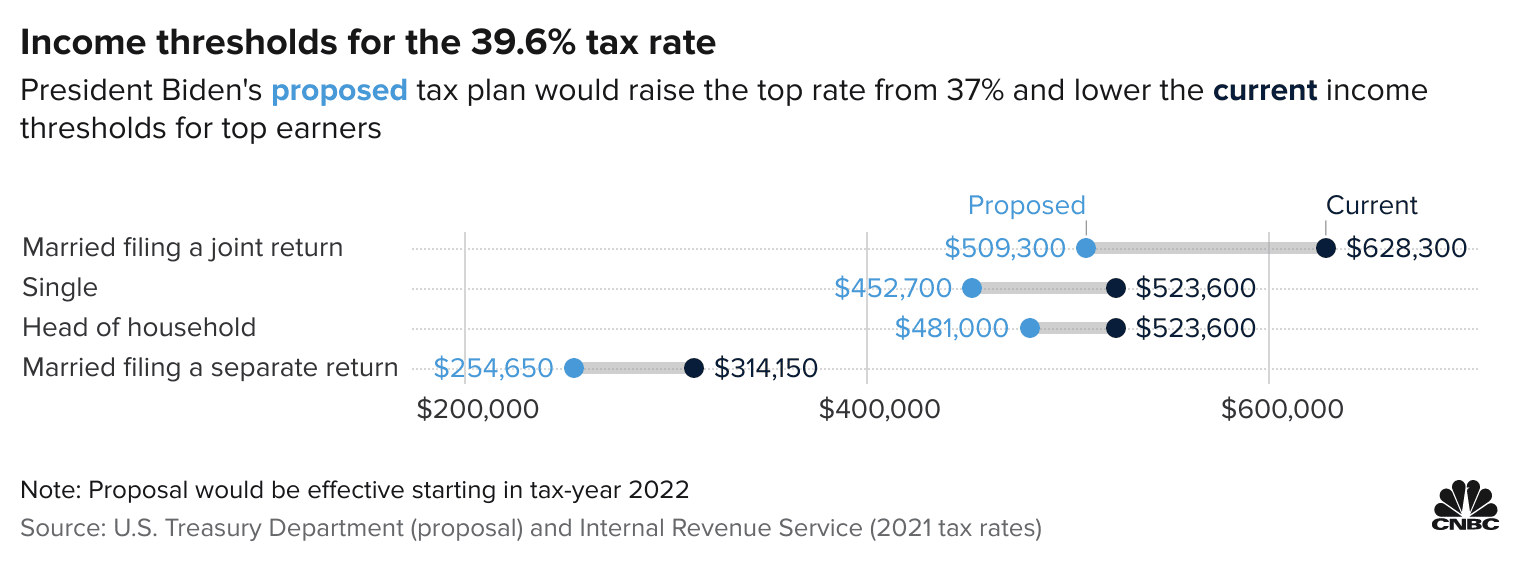

Another would raise the capital gains tax rate to 396 for taxpayers. If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows.

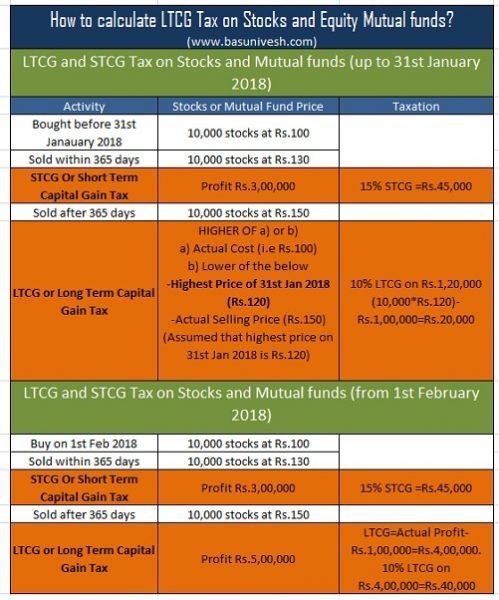

Cost Of Inflation Index Fy 2021 22 Ay 2022 23 For Capital Gain Basunivesh

As a result if their income ranges from 40401 to 445850 they will be taxed on capital gains at 15 percent.

. The rates do not stop there. President Joe Biden would raise the top tax rate on capital gains and dividends to almost 49 between federal and state taxes. There are exceptions to this such as when it was 15 from 2004 to 2012.

Currently the capital gains tax rate for wealthy investors sits at 20. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. What is the capital gains tax rate for 2021.

Historically capital gains tax has sat around 20. There is a change on the horizon which can take place as soon as 2022. A high income level results in a 20 percent tax rate.

Assets other than stocks may have different rates for capital gains taxes. Above that income level the rate jumps to 20 percent. For 2021 reporting year the federal short-term capital gains rate is the same as your ordinary income tax rate where your tax rate is dependent on your total income ranging from 10 to 37.

13 2021 and will also apply to Qualified Dividends. According to the IRS the salary brackets for 2022 have increased just slightly. Unlike short-term capital gains tax brackets for long-term capital gains are 0 percent 15 percent and 20 percent.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. While there are no sweeping federal tax changes taking effect in 2022 several updates affect individual filers. Will capital gains change in 2021.

Additionally a section 1250 gain the portion of a. If your income was 445850 or more. For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income.

However theyll pay 15 percent on capital gains if their income is 40401 to 445850. What Is The 2021 Capital Gains Tax Rate. While there is still time to see how 2022 capital gains will play out the tax hit for 2021 is a known quantity and the time to reinvest capital gains realized from the sale or exchange of capital assetswhether stocks bonds commodities precious metals businesses real estate patents trademarks collectibles livestock etcduring.

The proposal is bumping this up to 396. Short-term gains are taxed as ordinary income. If your income was between 0 and 40400.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Joe Biden says. 4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25.

The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. Discover Helpful Information and Resources on Taxes From AARP. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a.

Capital Gains Tax Rate 2021. Accountants and tax planners say the bigger impact would have come from the Build Back Better infrastructure bill which includes proposals to increase capital gains tax limit the 20 deduction. According to the IRS individual filers will not be taxed on capital gains in 2021 for amounts less than 40400.

Only Ireland has a higher rate. The maximum capital gains are taxed would also increase from 20 to 25. Your 2021 Tax Bracket to See Whats Been Adjusted.

If your income was between 40001 and 445850. 2021 Federal Income Tax Rates For taxes due in April 2022 Tax Rate. 4 rows The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35.

Ad Compare Your 2022 Tax Bracket vs. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. This new rate will be effective for sales that occur on or after Sept.

One of the proposals Congress is considering sets the top rate for taxing capital gains at 25 up from 20 under current law. The long-term capital gains tax rates remain the same for 2022 but the income thresholds have been adjusted for inflation. In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. Capital gains tax rates on most assets held for.

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gain Income Assest Tax Ltcg Stcg In India Tax2win Tax2win

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gain Tax On Transfer Of Unlisted Equity Shares

Capital Gain Income Assest Tax Ltcg Stcg In India Tax2win Tax2win

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)